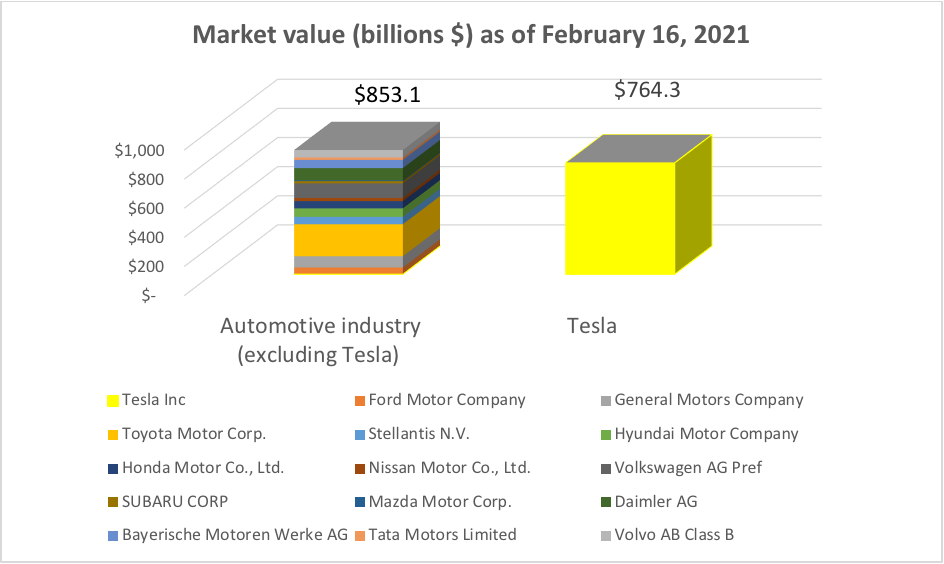

Comparison between TESLA and the rest of the global automotive industry

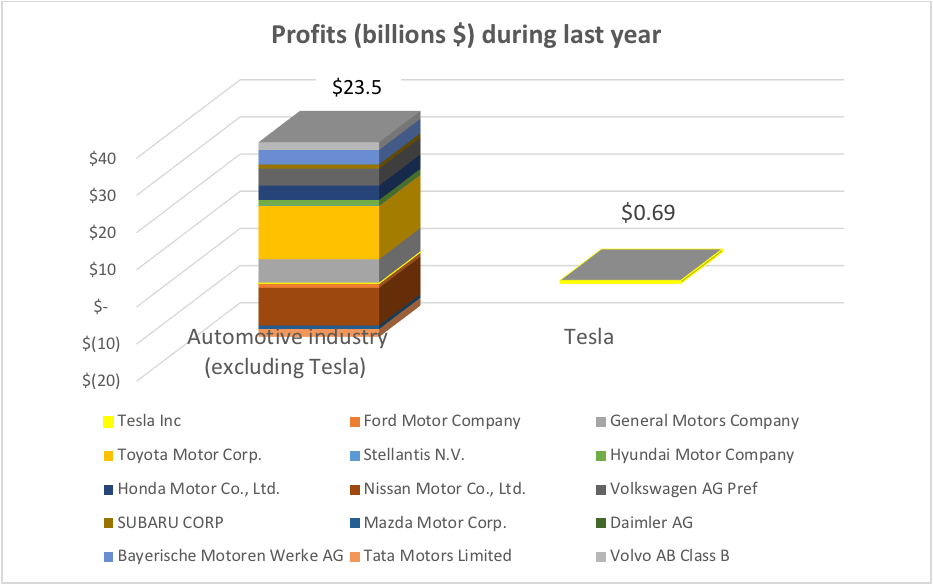

First, we analyzed Tesla in comparison to the rest of the global auto industry. All of the companies included in the industry are found below the graph below.

Source : Factset

As of February 16, 2021, Tesla's market value was just over $764 billion, while the sum of the rest of the industry was just over $853 billion. On its own, Tesla is therefore worth almost as much as the rest of the global industry in terms of market capitalization!

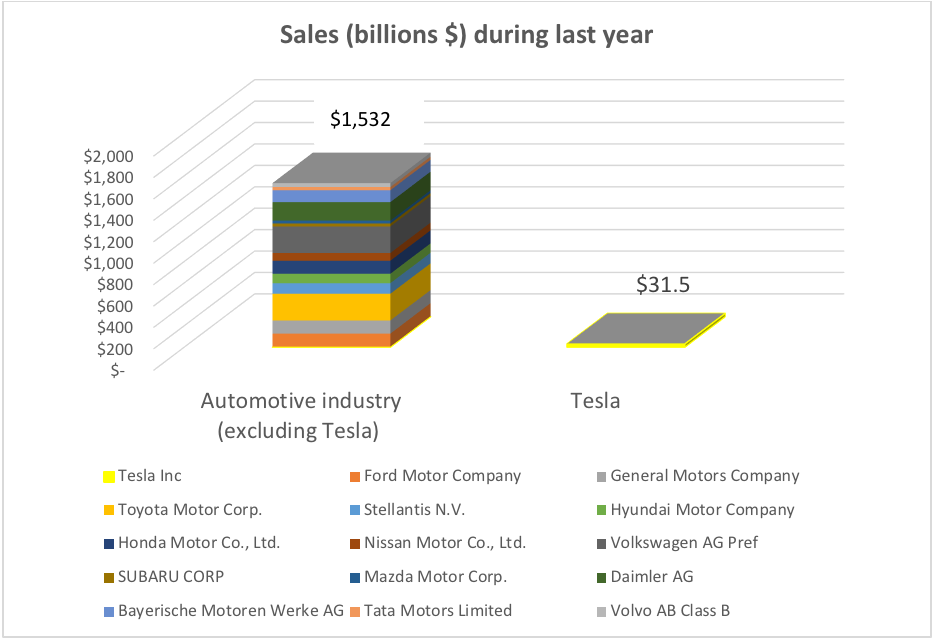

Source : Factset

However, Tesla only made sales of around $31.5 billion last year, while sales for the rest of the industry were $1,532 billion for the same period. Tesla's value is therefore equivalent to the sum of the rest of the automotive industry, while its sales represented only 2% of the entire industry last year!

It is also worth mentioning that 5% of these sales ($1.58 billion) come from the sale of regulatory credits. While 5% of sales may not be significant, when you look at the profits, it's a whole different story...

Source : Factset

Last year, Tesla generated profits of $0.69 billion while the industry's profits totalled $23.5 billion. Tesla's profits in 2020 therefore represented 2.85% of total industry sales. However, excluding the sale of carbon credits, Tesla would have had a loss of several hundred million dollars last year!

Comparison between TESLA and the average of the 20 largest companies in the world

We did the same analysis but this time comparing Tesla to the 20 largest companies in the world by market capitalization. Here they are:

| Apple | Tencent | Visa | Mastercard |

| Saudi Aramco | Johnson & Johnson | Procter & Gamble | |

| Microsoft | Alibaba | Walmart | Nestle |

| Amazon | Taiwan Semiconductor | JPMorgan | Roche |

| Alphabet | Samsung | UnitedHealth | Intel |

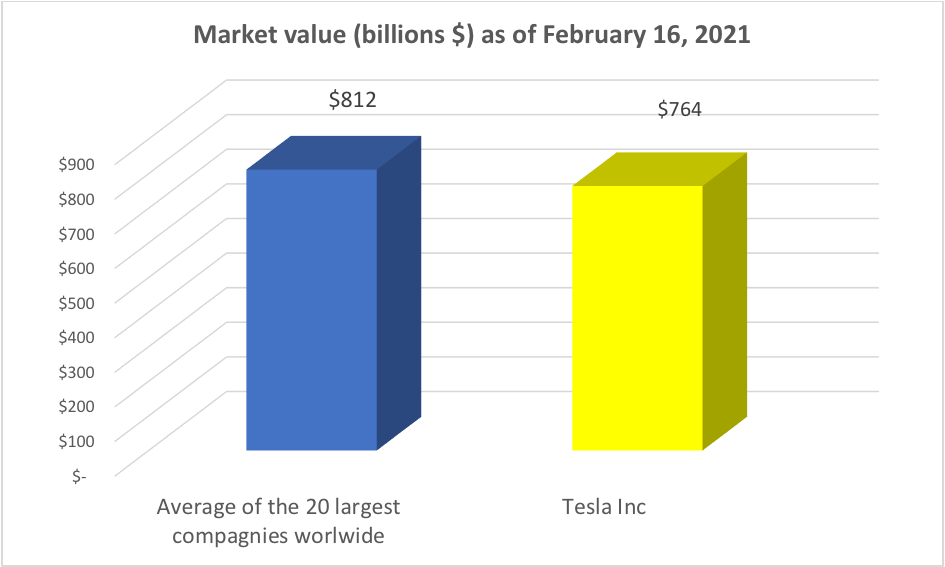

Source : Factset

We can therefore observe that the stock market value of Tesla is almost identical to the average of the 20 largest companies.

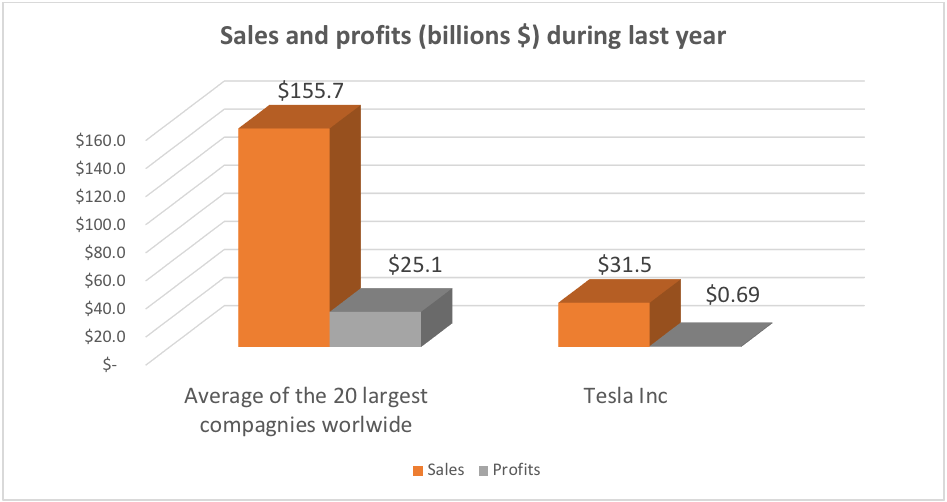

Source : Factset

However, Tesla's sales are nowhere near the sales for the other companies of its standing. In fact, the 20 largest companies in the world generated on average five times more sales than Tesla last year! In terms of profits, the comparison is all the more dire. The 20 largest companies in the world generated on average just over 36 times Tesla's profits over the same period! So why is Tesla's worth almost equal to these large companies on average if it only manages to generate a fraction of their profits?

Some would argue that Tesla's value is justified by its future growth rate. To test this theory, we used a sample of the six companies1 that experienced the greatest sales growth in 2020 among the 20 largest companies. On average, these six companies grew by 27%, which is very close to Tesla's 28% growth. The six companies trade on average at 44 times their profits, while Tesla trades at nearly 1,108 times its profits! At an equivalent growth rate, if Tesla had also traded at 44 times its profits, it should have generated $17.4 billion in profits rather than $0.69 billion!

In conclusion, Tesla's excellent stock market performance is undeniable. The stock has gone from US $83.67 to US $705.67, an increase of 743% in the space of a year! On the other hand, history has shown us, especially during the tech bubble in 1999, that a company's fundamental value does matter in the long run. Whether compared to its industry or to other players with the same level of growth, Tesla's value is simply not rationally justified.

1 Microsoft, Amazon, Tencent, Facebook, Alibaba and Taiwan Semiconductors

2 Market values as of December 31, 2019 and as of December 31, 2020

Disclaimer

Information in this article is from sources believed to be reliable; however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Marc-André Turcot, and not necessarily those of Raymond James Investment Counsel Ltd. Investors considering any investment strategy should consult with their investment advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision.