In this article, we are addressing young people more in particular. We want to share with you our winning recipe to help you take charge of your financial future.

The first step is to determine a goal to achieve. In this case, we are talking about a monthly retirement budget. In the table below, you can see different monthly budget levels, as well as the age at which you will start saving. You will quickly find that the earlier you start, the less it costs. Take, for example, a goal of receiving $ 4000 per month aged 65 to 100. You will need to save $ 545 per month if you start at age 25, while you will need to save almost double, or $ 975 per month, if you start at 35.

TFSA monthly contributions required to reach your retirement goal*

| Desired monthly budget at retirement (net of taxes, in today’s $) | ||||||||

|---|---|---|---|---|---|---|---|---|

| $ 3,000.00 | $ 3,500.00 | $ 4,000.00 | $ 4,500.00 | $ 5,000.00 | $ 5,500.00 | $ 6,000.00 | ||

| Current age | 20 years old | $ 310.00 | $ 360.00 | $ 415.00 | $ 465.00 | $ 520.00 | $ 570.00 | $ 625.00 |

| 25 years old | $ 405.00 | $ 475.00 | $ 545.00 | $ 610.00 | $ 680.00 | $ 750.00 | $ 820.00 | |

| 30 years old | $ 535.00 | $ 630.00 | $ 720.00 | $ 815.00 | $ 905.00 | $ 995.00 | $ 1,090.00 | |

| 35 years old | $ 725.00 | $ 850.00 | $ 975.00 | $ 1,100.00 | $ 1,225.00 | $ 1,350.00 | $ 1,470.00 | |

| 40 years old | $ 1,005.00 | $ 1,180.00 | $ 1,350.00 | $ 1,525.00 | $ 1,695.00 | $ 1,870.00 | $ 2,040.00 | |

Source : NaviPlan

* Conditional to available room in TFSA (gray boxes indicate that TFSA is most likely full)

* Rounded up to the closest 5$

* Contributions are indexed for inflation

| Hypothesis | |

|---|---|

| Retirement age | 65 |

| Life expectancy | 100 |

| Annual return (stocks)* | 9% |

| Management fees (taxes included) | 1.44% |

| Net annual return | 7.56% |

| Inflation rate | 2.50% |

| QPP | No |

| OAS | No |

* Source : http://www.econ.yale.edu/~shiller/data.htm

« I don’t have any money for this »

If the amounts indicated seem impossible to achieve, we can start by looking at your budget. To aim for a specific monthly retirement budget, it is imperative to know your current monthly budget. While it's true that some people really can't afford to save these amounts, for many people these amounts simply represent more strategic consumer choices.

For example, choosing to make your own coffee at home instead of paying $ 2.30 at a coffee counter. It's also about choosing to make your own sandwich instead of paying $ 6.30 at a restaurant or driving a car with monthly payments of $ 300 instead of $ 700. We're not saying don't drink coffee, eat sandwiches, nor buy a car. All that is being said is that you have to make an informed choice that can save you a lot of money in the long run. These three choices combined, at age 25, represent savings of $ 570 per month. With this amount, we can afford a retirement at $ 4000 per month later!

If you are lucky and can afford the “expensive” choices in addition to putting in the necessary amount for retirement, so much the better! But we know that most people don't. The question must therefore be asked: by making this choice, am I penalizing my quality of life when I stop working?

Risk-reward concept

A crucial point in reaching retirement goals is the investment decision. Choosing between cash, fixed income and stocks has a huge impact on the bottom line. Here is an example of a monthly contribution of $ 500 for a 25-year-old who contributes until retirement, that is, for 40 years. This amount is fixed, therefore not adjusted for inflation.

| Cash | Fixed Income | Stocks | The « dreamer » |

|---|---|---|---|

| 0,85%* | 1,15%* | 9,00%** | 20,00% |

| 500$ / month | 500$ / month | 500$ / month | 500$ / month |

| After 40 years | After 40 years | After 40 years | After 40 years |

| $285,998.91 | $304,703.16 | $2,122,377.00 | $48,602,335.00 |

* Returns as of June 25, 2020

** S&P500 historical return (Shiller)

For a total investment of $ 240,000 ($ 500 per month for 40 years), cash is $ 285,998.91, while fixed income is $ 304,703.16 and stocks are $ 2,122,377.00. Although these are expected returns, one can easily see the magnitude of the difference between each result.

To put things in perspective, we did the same exercise with a 20% rate, which we called the “dreamer”. With a result of $ 48,602,335, it can be seen that achieving this kind of return every year over the long term is unrealistic.

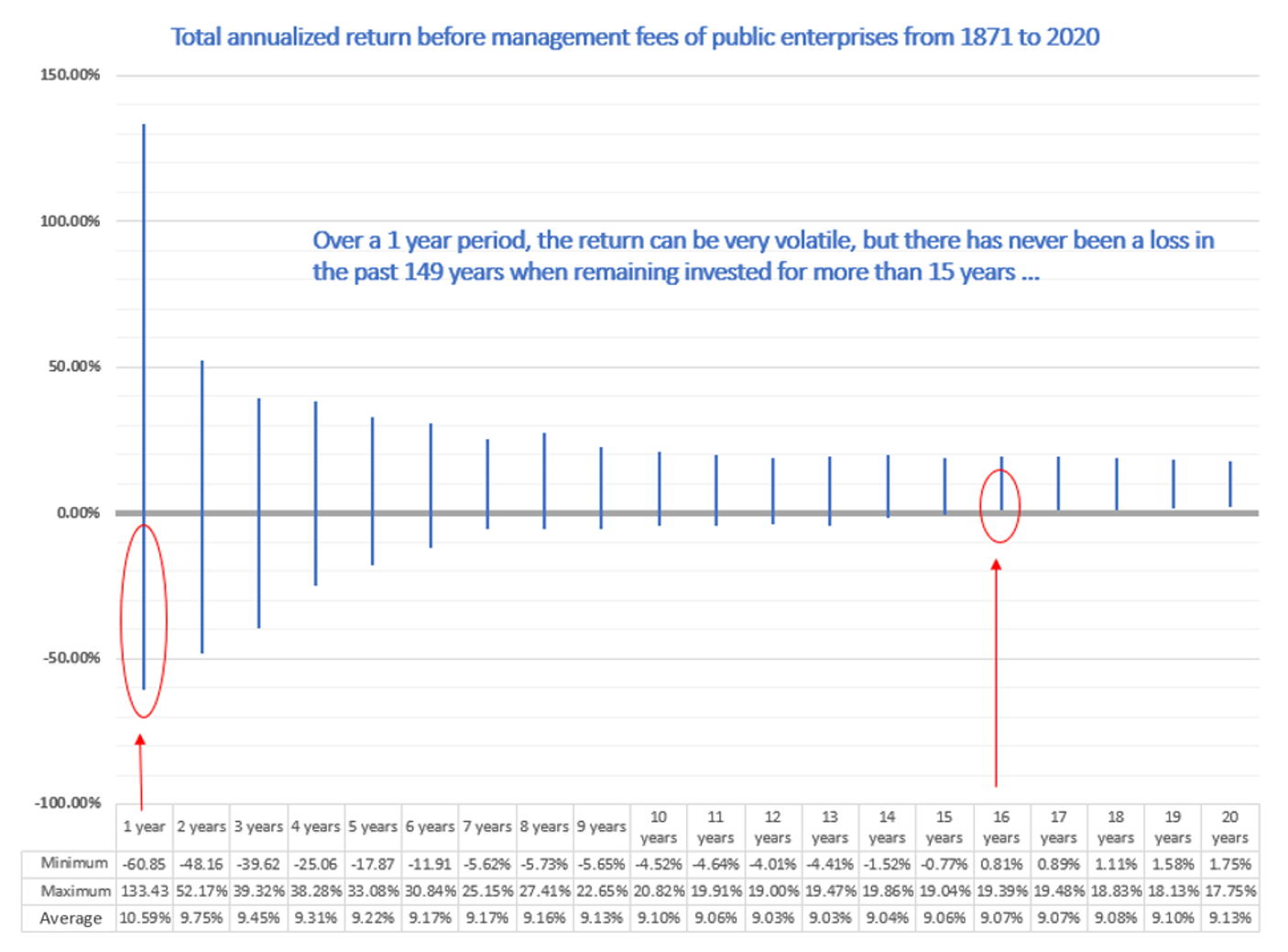

We therefore believe that it is important to invest your savings in stocks in order to be able to achieve the desired objectives. However, always consider "when am I going to need the money"? According to Shiller's study, the stock market (S&P500) has never experienced a negative return after 16 years, including the great depression! There is therefore no "rational" reason to invest an amount that we will need in over 16 years elsewhere than on the stock market.

Since the initial matrix talks about the amounts that need to be invested in anticipation of retirement, therefore in the long term, we consider it logical to invest in stocks.

Why should you take your retirement into your own hands?

- There are fewer and fewer companies offering pension funds.

- We should not rely on government programs because with the level of government debt which is only increasing and with the aging of the population, we cannot be sure of the amounts of money that will be available in the future.

- We have not taken into consideration other retirement benefits (such as the QPP and the OAS) to give people a general idea of the savings efforts you need to make to reach a certain level of income by themselves.

Disclaimer

Information in this article is from sources believed to be reliable; however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Marc-André Turcot, and not necessarily those of Raymond James Investment Counsel Ltd. Investors considering any investment strategy should consult with their investment advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision.